Cross-border payments have risen over the last two decades as globalisation and an increasingly connected world has become the norm. Cross-border transactions are payments sent from one country to another. Bank and transfer fees, local and foreign currency conversion rates and exchange fees may apply to these transactions. Due to globalisation, an increasing number of businesses are choosing overseas suppliers, consequently causing a surge in cross-border payments. In a study conducted by PayStream Advisors and Tipalti, they found that 73% of companies based in the United States are making regular cross-border payments. With an efficient international payment strategy, businesses can improve their return on investment (ROI).

History

International commerce has been around for centuries, with one notable example being the Silk Road. The Silk Road was a network of Eurasian trade routes that began in the second century BCE and ended in the 15th century, spanning over 6.4km. This allowed merchants to exchange goods and services across the East and West. According to the Faster Payment Council, the timeline goes as follows:

1817 – First recorded cross-border payment. The Bank of England sent payment to the Bank of France.

1858 – First international money transfer system was established between England and France.

1871 – The first electronic funds transfer took place. Western Union debuted EFT, the first time goods could be paid for without someone being present.

1944 – IMF and World Bank established. The Bretton Woods agreement established the IMF and World Bank, as well as an international framework of international payments and currency exchange.

1960 – The EuroDollar market was created that allowed banks to make cross-border payments in US dollars.

1970 – The Clearing House Interbank Payment System (CHIPS) was introduced and became critical to the global economic infrastructure.

1977 – SWIFT launched.

1999 – The Euro became the currency of the European Union, making cross-border payments more efficient.

2017 – SWIFT launched GPI which enabled faster, traceable and transparent cross-border transactions.

Mobile money, made popular by digital banks and fintechs alike, has eased the cost and increased the speed of international transactions. In 2011, a UK fintech, now known as Wise, was the first to introduce cross-border payments. Since then, fintechs have opted to improve the historic international payment system which was built on bank-to-bank networks. Traditionally, settlement times are slow and carry expensive processing fees. This in turn limits growth of all those involved.

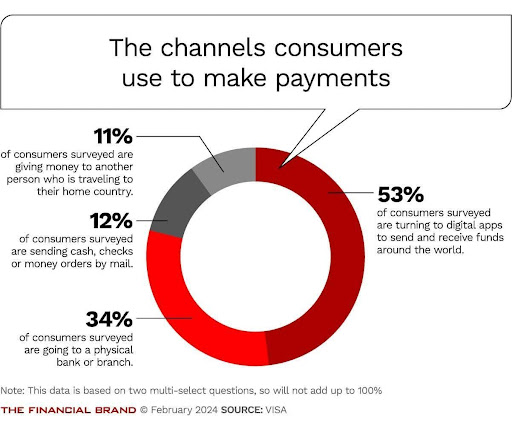

Customers are increasingly heading to digital banks in a market where traditional technology has dominated. According to a 2023 survey from Visa, mobile apps have become ‘more popular than legacy systems among consumers who routinely send and receive funds in 10 key remittance zones’.

One fintech that has improved cross-border payments is Toronto-based Black Banx. German billionaire Michael Gastauer is owner and CEO of the digital bank and successfully launched the platform in 2015 with a moderate 200,000 customers. Since then, Black Banx has dominated the global market and currently has a user base of over 39 million. Black Banx customers have access to a range of services that put the company as a leader of the digital banking industry. Private and business clients can take advantage of real time 24/7 currency exchange services, interest savings bearing accounts, international payments in 28 FIAT (government issued currencies) and two cryptocurrencies, as well as real time 24/7 crypto trading services, among others. Black Banx provides customers banking access without restrictions based on nationality, country of residence, religion, and amount of funds held or transferred. Its aim is to increase the simplicity of online banking, reduce transaction times and achieve financial inclusion.

Led by Gastauer, Black Banx has sought to revolutionise international transactions. By employing innovative technology and new partnerships, Black Banx eliminates the traditional troubles associated with cross-border payments. Transaction times are reduced and the process is a lot easier than conventional banking.

Future of Cross-border Payments

Global payments are expected to rise from $190 trillion in 2023 to $290 trillion in 2030. Companies such as PayPal, Black Banx and Wise are expected to continue seeing demand and need for seamless international transfers. Over the next few years, it’s expected that each of these companies expands and further improves their cross-border payment processes allowing customers to send and receive internationally with unprecedented ease.

Artificial intelligence (AI) and machine learning (ML) are poised to alter cross-border transactions by improving security, compliance, and the user experience. AI can assist in detecting and preventing fraud in real time, automate compliance checks, and provide consumers with personalised services based on their transaction history. As these technologies advance, they will significantly speed cross-border payments while ensuring their security and dependability.

The future of cross-border transactions promises to be faster, more efficient, and more inclusive, thanks to technical advancements, legislative changes, and the rise of new global payment platforms. As the global financial system grows increasingly linked, individuals and organisations will want to be able to undertake safe, rapid, and cost-effective international transactions. The continuous advancements in this industry have the ability to change the global finance landscape while also promoting a more inclusive and equitable economic future for everybody.