What is Interest Coverage Ratio?

Any business that takes out a loan must pay interest on the loan.

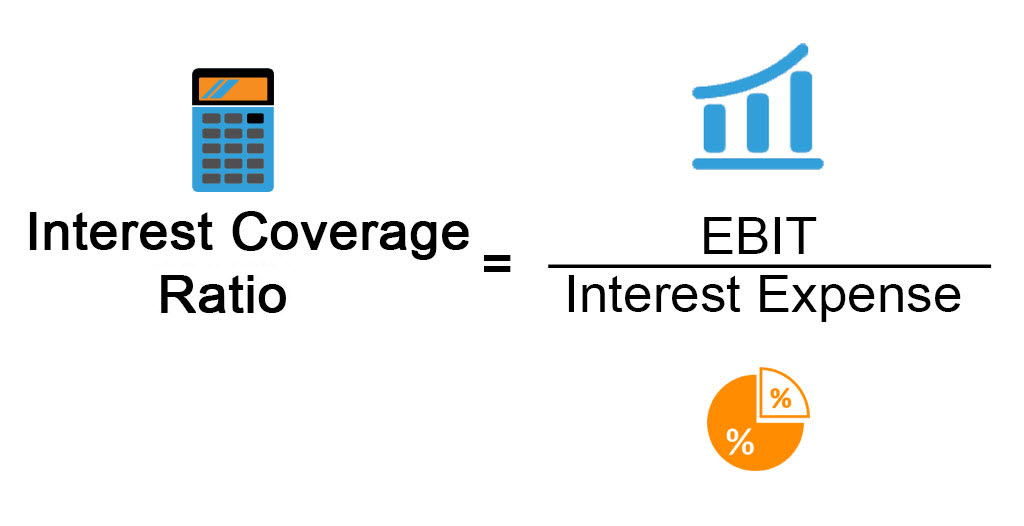

The ratio of interest to coverage is:

The maximum number of times a business may pay interest using earnings before interest and taxes, or EBIT; this is sometimes expressed as EBIT / interest expenses (EBIT).A company’s operating profit is also known as its current debt and its ability to pay interest on the same EBIT.

To better grasp the idea of the interest coverage ratio, let’s look at the following example:

For the most recent quarter, Company X’s sales and expenses are as follows:

- Revenues: Ten lakh rupees

- 1,50,000 rupees is the cost of items sold.

- Running costs come to Rs. 50 000.

Earnings are equal to revenues minus operating expenses minus cost of goods sold, or Rs. 8,00,000.

- Monthly interest payment on loan is Rs. fifty thousand.

By changing the monthly interest payment to a quarterly payment, the interest coverage ratio may be calculated:

- The quarterly interest payment is going to be = Rs. 50,000×3 = Rs. 1,50,000.

- ICR is equal to 8,00,000 / 1,50,000, or 5.33.

This suggests that the company’s earnings are enough to cover interest payments five and a half times.

Understanding the interest coverage ratio

A corporation may have a heavier debt burden and a higher risk of failure or bankruptcy if its ICR is less than 1. A lower ICR ratio suggests that the company may have to pay a higher interest rate due to its inadequate earnings.

An ICR of less than 1.5 indicates that the company’s standing is impeding its ability to obtain more borrowing from lenders.

An ICR of more than 1.5 indicates that the company’s earnings are sustainable. A greater ratio shows that the business is doing well financially and isn’t employing debt to boost profits at the expense of other hazards.

Uses of Interest Coverage Ratio

Financial Analysis: Financial analysts use ICR ratios to assess companies’ ability to meet their interest commitments. By comparing earnings or cash flows generated with its interest expenses, stakeholders can assess its ability in debt service and overall financial health.

Creditworthiness Assessment: Creditors and lenders can use ICR ratios as helpful tools when determining the creditworthiness of a borrower. Additionally, such a high ICR ratio could be indicative of reduced default risk among other things like better financing terms for borrowers including low interest rates.

Making Investment Decisions: Investors can evaluate the risk profile and financial stability of a company using ICR ratios before investing.

Risk management: The ICR ratio is an effective tool for reducing risks. It helps determine if a particular firm has enough capacity to withstand money shocks, changes in interest rates or declines in economic growth. Businesses are encouraged to proactively manage their debts as well as financial risks by keeping track of their ICR ratios.

Limitations of Interest Coverage Ratio

Prior to utilising the interest coverage ratio, investors should be aware of its limits, as with any indicator designed to assess the effectiveness of a company.

First of all, it’s crucial to remember that interest coverage varies greatly between businesses in the same industry as well as between businesses in other industries. An appropriate criterion for established corporations in specific industries, like utility companies, is often an interest coverage ratio of two.

Because of government controls, a well-established utility will probably have stable revenue and production, thus, even with a somewhat low interest coverage ratio, it might be able to pay interest on time. Some sectors, including manufacturing, are prone to greater fluctuations and frequently have minimum acceptable interest coverage ratios of three or greater.

These businesses typically see more fluctuations in their company. For instance, the 2008 recession severely impacted the auto manufacturing sector due to a sharp decline in car sales, the St. Louis Federal Reserve Bank: “Auto Sales and the 2007-09 Recession.”

Another unforeseen circumstance that could harm interest coverage ratios is a workers’ strike. These industries must rely more on their ability to cover interest to make up for times when earnings are low because they are more vulnerable to these changes.

Due to the significant differences between industries, a company’s ratio ought to be compared to those of similar companies—ideally with comparable revenue and business structures. Additionally, even while all debt should be considered when determining the interest coverage ratio, businesses may decide to include or exclude particular categories of debt from their computations. As such, it’s crucial to ascertain whether all debts were included in a company’s self-published interest coverage ratio.

Significance of Interest Coverage Ratio

Because it offers insightful information about a company’s risk profile and financial health, the ICR is a crucial tool in financial analysis. The Interest Coverage Ratio is important for the following reasons:

Assessing the Ability to Service Debts

By calculating a company’s ability to pay interest costs out of operational earnings, the ICR can be used to evaluate its ability to service debt. An improved ability to make interest payments may be indicated by a higher ICR, assuring investors and creditors of a decreased default risk.

Assessing Financial Stability

The ICR indicates the degree of risk and stability of a company’s finances. An increased ICR indicates a stronger financial situation, indicating that the business can make enough money to pay its interest costs. On the other hand, a lower ICR ratio may cause investors to question the company’s solvency and debt management skills.

Comparing and Benchmarking

One of the most important ways to measure and assess a company’s performance is to compare the Interest Coverage Ratio to comparable companies and industry norms. A company’s ICR can be compared to industry benchmarks and peer comparisons to see if it meets expectations. Substantial departures from industry standards or falling behind rivals could be signs of impending financial difficulties or inefficiencies.