When we say candlestick, only one thing comes to mind: a candle. But here candlesticks mean different. Here, it is a useful visual tool used by financial market traders. They help to assess and track the movements of a specific price over time. Candlestick indicators are technical indicators that are used to analyze the market. Traders can use the patterns to understand how the market feels about a particular financial item. A bullish pattern known as a hammer candlestick, for example, is created when an asset’s price drops from its beginning price. Then it touches the support level before rising again to close at a high.

When we talk about bullish candlesticks, the hammer candlestick is one of the most common ones. Traders need to stay aware of this pattern. Today, we will be studying hammer candlesticks in detail. From description to usage, everything is mentioned below

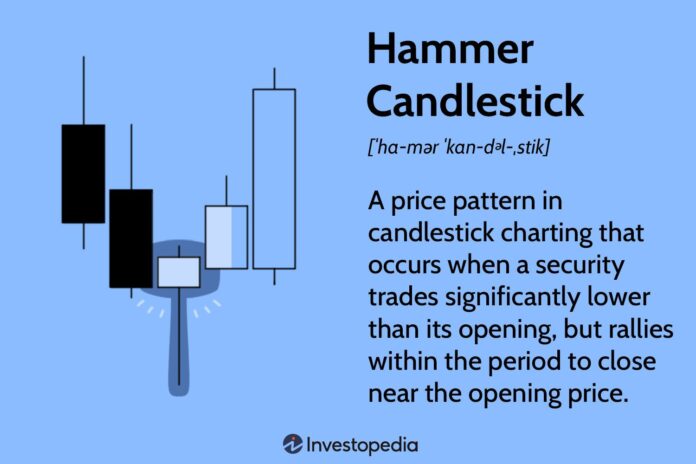

Describing hammer candlesticks:

The hammer candlestick is found at the lowest point of the downtrend. It signals a (potential) reversal in the market. A hammer is a type of candlestick pattern that appears when a stock opens, declines significantly during the day, and then rises back up to the opening price. The opening and closing price bodies form what appears to be the hammer’s head. The extended lower wick from the day’s lows looks like the handle of the hammer. The lower wick is typically twice as large as the candle body. It can be bigger than this though.

When the high and the close coincide, a bullish Hammer candlestick forms. This is seen as a stronger pattern because the bulls were able to completely reject the bears and drive the price higher before the starting price.

The long lower shadow of the Hammer suggests that the market conducted a test to determine the locations of demand and support. As soon as the market reached the day’s lows, which served as support, bulls started driving prices upward, almost to the opening price. Thus, the bulls rejected the negative surge lower.

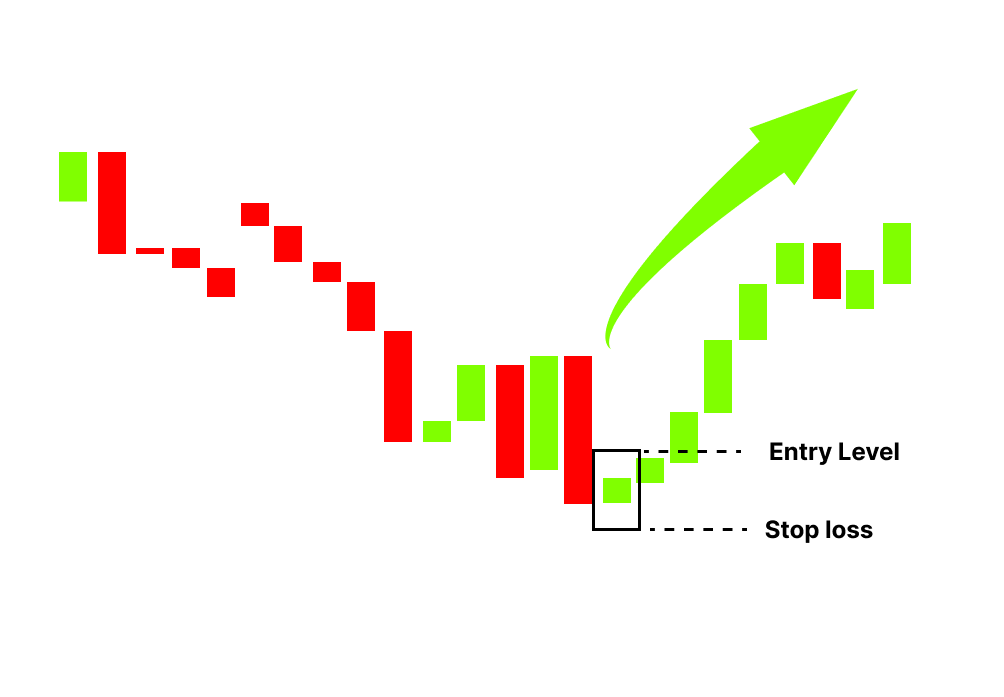

Trading tips while using hammer candlestick pattern:

- The longer the lower shadow ensures a strong potential bullish reversal.

- The possibility of a reversal is strengthened if the pattern develops at a support or Fibonacci retracement level.

- Before making a deal, always wait for a confirmation candle to appear. False signals may result from acting just based on the Hammer candlestick.

- For optimal results, the Hammer Candlestick pattern, like all trading patterns, should be utilized in conjunction with other technical analysis tools.

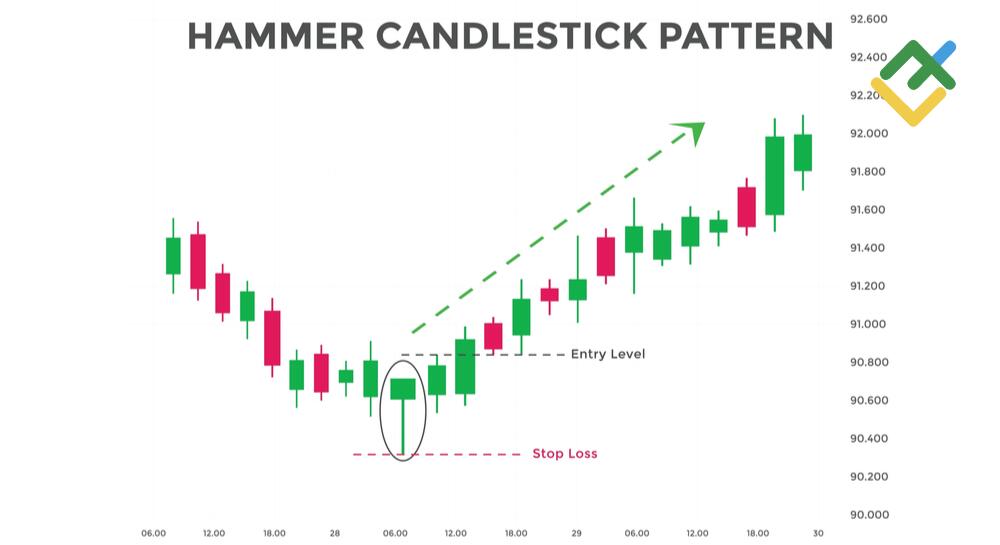

Example of hammer candlestick:

Let’s say a stock has been steadily declining for the previous 20 periods. A Hammer candlestick forms in period 21. There is little to no top shadow and a lower shadow that is twice the length of the body.

A lengthy green candlestick appears in the 22nd period and closes above the Hammer candle. This provides compelling evidence of a bullish reversal. At the beginning of the 23rd session, you can enter with a stop loss placed below the Hammer’s lowest point and a profit objective set at twice the stop loss level.

Do not forget that there is risk involved in trading; therefore having a good risk management plan in place is crucial. Like many trading patterns, the Hammer Candlestick is not foolproof, but when applied properly, it can provide helpful information.

Limitations of this candlestick:

After the confirmation candle, there is no guarantee that the price will keep rising. Within two periods, a long-shadowed hammer and a strong confirmation candle can drive the price extremely high. The stop loss could be far from the entry point, exposing the trader to a risk that isn’t worth the possible gain. This might not be the best time to buy for many traders.

Another point to note, hammers don’t provide us with a price target. It can be challenging to determine the possible reward from a hammer transaction. You can use other patterns as well for better results.

Importance of hammer candlesticks:

- This acts as a leading intraday signal pointing to a change in momentum toward bulls or bears.

- This indicator helps in figuring out a high or low. This also helps in finding out if that high or low will happen or not.

- Significance adds on with the timeframe and length of shadow (ideally 2-3 times the size of the body).

- Hammers may also help confirm and strengthen other important reversal indicators.

- A hammer bottom fails if the subsequent candle reaches a new low, and a hammer fails if a new high is reached just after its completion.

The difference between a Doji and a Hammer candlestick:

Another kind of candlestick with a small real body is called a doji. A doji has both a lower and upper shadow that signifies indecision. Depending on the confirmation that comes next, Dojis might indicate either a trend continuance or a price reversal. This is not the same as the hammer, which happens after a price decline. It has only a long lower shadow. Unlike Doji, Hammer shows a potential upside reversal

What is a shooting star? Is it different from a hammer candlestick?

A shooting star pattern denotes a bearish price trend, whereas a hammer candlestick pattern implies a bullish turnaround. Shooting star patterns happen immediately after a stock uptrend, showing an upper shadow. The shooting star candlestick rises after opening. It closes approximately at the same level as the trading period. This point makes it the reverse of a hammer candlestick. A shooting star pattern denotes the peak of a price trend.

Patterns like these help us understand trades and the hidden meanings behind them. Candlesticks like these also help us achieve big wins.