In the realm of finance, investment, and asset management, property valuation serves as a cornerstone, offering invaluable insights into the worth of tangible and intangible assets. While the focus often gravitates towards real estate appraisal, a deeper exploration reveals a broader spectrum of valuation, including business, plant, and machinery properties. Within this expansive panorama, the role of expert valuation services, such as Sydney Property Valuers Metro, emerges as paramount for accurate assessments and informed decision-making.

Understanding Business Property Valuation

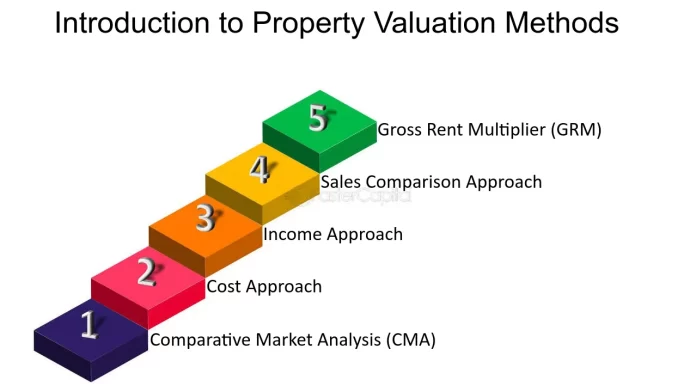

Business property valuation is a diverse interaction that includes surveying the total of unmistakable and elusive resources possessed by a business substance. Past simple actual foundation, it envelops factors, for example, brand esteem, protected innovation, client connections, and market situating. The valuation strategies utilized in business property valuation are different and dynamic, custom fitted to suit the exceptional attributes of every business. Among the most widely recognized approaches are the pay approach, market approach, and resource based approach.

The pay approach centers around assessing the current worth of expected future incomes produced by the business. This strategy is especially pertinent for organizations with stable income streams and unsurprising development designs. On the other hand, the market approach depends on contrasting the subject business with comparative ventures that have as of late been sold. By breaking down similar deals information, this technique gives experiences into market patterns and valuation products.

In the interim, the resource based approach decides the worth of a business by adding the honest evaluation of its substantial resources and immaterial resources, like licenses, brand names, and generosity. This strategy is frequently used for organizations with significant actual resources or in circumstances where future profit are questionable.

Delving into Plant Property Valuation

Plant property valuation envelops the appraisal of fixed resources used in assembling, creation, or modern cycles. These resources incorporate hardware, gear, specific instruments, and framework fundamental for the activity of a plant or office. Key contemplations in plant valuation incorporate the state of resources, mechanical out of date quality, substitution cost, and market interest for explicit hardware. For example, a plant with best in class hardware might order a higher valuation than one with obsolete gear requiring continuous upkeep and fixes.

Valuation procedures in plant property valuation are custom fitted to address the remarkable attributes of modern resources. The expense approach includes assessing the ongoing substitution cost of resources, taking into account factors, for example, devaluation and economic situations. The pay approach evaluates the monetary advantages got from the useful utilization of plant resources, considering factors like limit usage, working costs, and future money flows.Additionally, the market approach thinks about the subject plant to comparable offices that have as of late been offered, investigating exchange information to decide honest evaluation. This technique gives experiences into winning business sector patterns and valuation products inside the modern area.

Exploring Machinery Property Valuation

Apparatus property valuation centers around deciding the value of hardware used across different areas, including horticulture, development, assembling, and transportation. Hardware resources range from large equipment and modern gear to specific apparatuses and vehicles. Factors impacting apparatus esteem include gear age, condition, usefulness, innovative progressions, and market interest. For example, very much kept up with hardware with low active times might order a higher valuation than more established gear requiring broad fixes and redesigns.

Valuation procedures in hardware property valuation are custom fitted to address the remarkable qualities of gear resources. The expense approach includes assessing the ongoing substitution cost of apparatus, taking into account factors like devaluation, support history, and economic situations. The deals examination approach dissects ongoing exchanges of comparative hardware to decide honest evaluation, considering variables like gear details, condition, and geographic area.

The pay approach evaluates the monetary advantages got from the useful utilization of hardware resources, taking into account factors like gear usage rates, working costs, and extended incomes over the resource’s valuable life.

Challenges and Considerations in Property Valuation

The scene of property valuation presents horde difficulties and contemplations for partners. Intricacy emerges from the different idea of resources, administrative structures, market elements, and financial circumstances. Exploring these difficulties requires skill, experience, and a nuanced comprehension of valuation systems and industry-explicit variables. Administrative consistence, changing economic situations, innovative headways, and globalization add layers of complexity to the valuation cycle.

Also, the abstract idea of valuation and the potential for irreconcilable situations highlight the significance of connecting with free and qualified valuation experts. Skill in monetary examination, statistical surveying, industry information, and valuation procedures is fundamental for guaranteeing exact evaluations and relieving chances.

Conclusion

All in all, property valuation reaches out past customary land evaluation to envelop a range of resources, including business substances, plants, and hardware. Grasping the subtleties of valuation procedures and exploring the intricacies of resource evaluation requires mastery, accuracy, and an exhaustive comprehension of industry elements. As the scene of property valuation keeps on developing, the job of master valuation administrations turns out to be progressively crucial. By giving precise evaluations, bits of knowledge, and key direction, valuation experts work with informed navigation, upgrade straightforwardness, and drive esteem creation for partners across ventures.

Looking forward, headways in innovation, information examination, and valuation techniques are ready to reshape the valuation scene, introducing new open doors and difficulties for partners. Embracing development, coordinated effort, and consistent learning will be fundamental for keeping up to date with arising patterns and staying serious in a steadily advancing business sector climate.