Mutual fund investment provides a convenient and diversified investment option for individuals looking to build wealth over time. By understanding the key concepts, types of funds, and considering important factors, investors can make informed decisions to achieve their aforesaid financial goals. Staying informed, regularly reviewing your investment strategy, and consulting a financial professional or mutual fund distributor as necessary are crucial parts of an enjoyable investing journey.

When you invest in mutual funds, here are some key or important concepts to keep in mind-

Net Asset Value (NAV): NAV (Net Asset Value) of a mutual fund scheme is its per unit market value and calculated by dividing its total asset value by outstanding units outstanding. NAV helps investors assess performance of mutual fund investment over time..

Diversification: Mutual fund investment offers investors diversification through investing across many securities. Diversification helps mitigate risk by spreading out investments among various industries or asset classes and reduces their impact on an individual’s overall portfolio.

Risk and Return: Risk and Return Potential: Mutual funds carry different levels of risk and return potential, often those offering greater returns also carry greater risk. Investors need to determine their individual tolerance level against that of each fund before selecting one as an investment option.

Types of Mutual Funds –

Here is some crucial knowledge you need when investing in mutual funds – here are the three primary types you should understand!

Active Funds: Active funds are mutual funds actively managed by fund managers in order to generate alpha against their respective benchmark..

Passive funds: ETF or exchange trader funds are passive funds. ETF mutual funds tries to replicate the return of a Benchmark and endeavours to give the same return the benchmark would give.

Under both types of mutual fund investment schemes, investors have access to equity, index, sectoral, and debt funds for investments. Active mutual funds offer even more choices of funds in which to invest than passive mutual fund schemes.

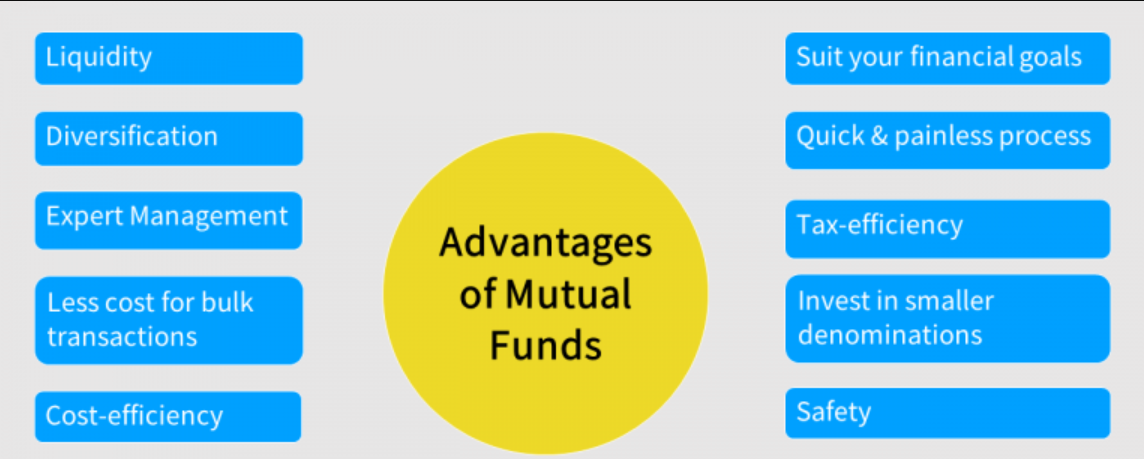

Benefits of Mutual Fund Investment-

When you decide to invest in mutual funds, here are the advantages you must note-

Professional Management: Mutual funds are managed by experienced, highly-qualified fund managers who make investment decisions after conducting in-depth research and analysis.

Diversification: Mutual funds offer investors the advantage of diversification with funds pooled from multiple investors investing across an array of assets in a diversified portfolio, spreading risk.

Liquidity: Mutual fund units can be bought or sold at market value on any trading day, providing investors with liquidity.

Mutual funds offer access for investors of varying investment capacities and experience levels, making them an appealing option both for novice investors and experienced ones alike.

Considerations for Investors –

As an investor, here are the points to consider when you invest in a mutual funds–

Investment Goals: Set clear investment goals that encompass wealth accumulation, retirement planning or saving for specific milestones.

Risk Tolerance: Assess your risk tolerance before selecting funds that align with both your comfort level and long-term objectives.

Fees and Expenses:It is important to consider all fees related to investing in mutual fund schemes, including expense ratios and exit loads, in order to evaluate whether an investment will provide value.

Performance Track Record: Examine the performance track record of mutual funds over both short-term and long-term returns to determine their past success.

Conclusion –

In this article, we have tried to understand mutual fund investment in a comprehensive manner to get a holistic outlook on the concept.